Up-to-date, standardised data

Access consolidated, up-to-date information at any time.

Access consolidated, up-to-date information at any time.

Access consolidated, up-to-date information at any time.

Access consolidated, up-to-date information at any time.

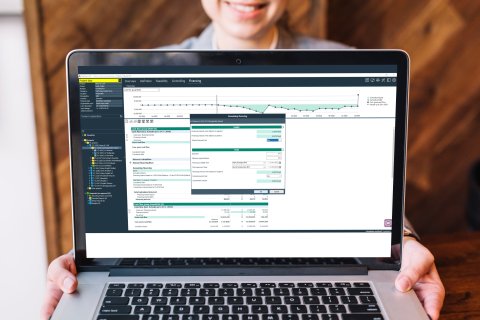

Determine the maximum capital requirement and the due date with just a few entries.

Determine the maximum capital requirement and the due date with just a few entries.

Calculate the financing interest automatically with just a few entries.

Calculate the financing interest automatically with just a few entries.

Access a metric and graphical representation at any time.

Access a metric and graphical representation at any time.

Back to Back to module overview >>>