IFRS 16 standards, how to get compliant?

IFRS 16 is a lease accounting regulation from the International Accounting Standard Board that requires publicly listed companies to include on their balance sheets all leasing contracts with a contract term longer than one year.

IFRS 16 is a lease accounting regulation from the International Accounting Standard Board (IASB) that requires publicly listed companies to include on their balance sheets all leasing contracts with a contract term longer than one year. IFRS 16 is the global standard for lease accounting, in combination with ASC 842 from the Financial Accounting Standards Board (FASB) in the United States. The IFRS 16 effective date for an entity to apply these standards for annual reporting periods was on or after 1 January 2019.

Because of the complexity of the lease accounting standards, IFRS 16 software is required to meet all the regulations and report in a compliant way. Learn in this article how to get started with IFRS 16:

- What are the differences between IAS 17 and IFRS 16? And what will be the impact?

- Learn from IFRS 16 examples.

- How to become IFRS 16 compliant.

Comparison between IAS 17 and IFRS 16

The previous accounting model for leases (IAS 17) required lessees and lessors to classify their leases as either finance leases or operating leases and account for those two types of leases differently. That model was criticised for failing to meet the needs of users of financial statements because it did not always provide a true representation of leasing transactions. In particular, it did not require lessees to recognise assets and liabilities arising from operating leases.

IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value. A lessee is required to recognise a right-of-use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments. This approach will result in a more realistic representation of a lessee’s assets and liabilities and, together with enhanced disclosures, will provide greater transparency of a lessee’s financial leverage and capital employed. According to the Europe Economics the three most operation lease-intensive sectors worldwide are airlines, retail and travel & leisure.

IFRS 16 establishes principles for the recognition, measurement, presentation and disclosure of leases, with the objective of ensuring that lessees and lessors provide relevant information that truly represents those transactions. [IFRS 16:1]

What will be the impact of IFRS 16 on the organisation?

As a result of moving from IAS 17 to IFRS 16, the main difference will be an increase in lease assets, finance lease liabilities and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation). The range of potential IFRS 16 impacts is wide: 53% of entities would experience an increase in debt over 25% (PwC).

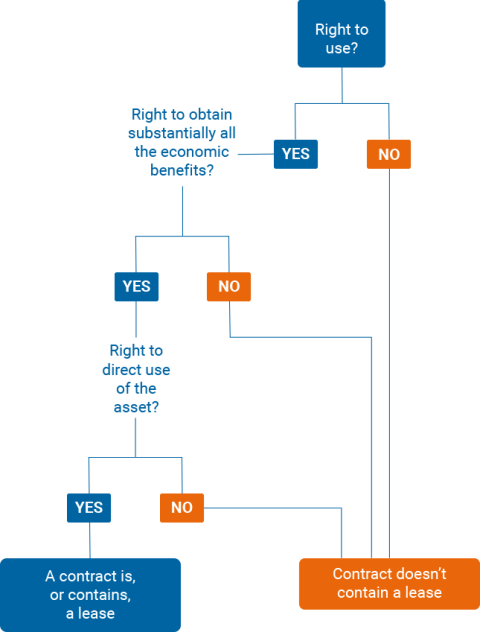

Identifying a lease

A contract is, or contains, a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration. [IFRS16:9]

Control is conveyed where the customer has both the right to obtain substantially all the economic benefits from use of the identified asset and to direct the use of that asset. [IFRS16:B9]

An entity shall apply this Standard consistently to contracts with similar characteristics and in similar circumstances.

Learn more about IFRS 16

TIP

Driven by IFRS 16 compliance, in 2016 TIP started a project to assess the impact on its financial statements based on the full retrospective transition approach. TIP selected Planon Universe because of its full cloud deployment.

Upptäck mer

Getting from here to there: The steps to transition from IAS 17 to IFRS 16

This white paper, created in collaboration with Accenture, provides an overview of the IFRS 16 standard, the impact it will have on your organisation, and what to consider as you begin your transition from IAS 17 to IFRS 16.

Lär dig mer

How new lease accounting standards will impact your business

There have been a lot of changes in lease accounting since 2019. Starting 1 January 2019, the Financial Accounting Standards Board (FASB) and the International Accounting Standard Board (IASB) implemented new standards, ASC 842 and IFRS 16 respectively. Download a free copy of this FAQ to get an overview of five frequently asked questions about lease accounting and our answers to them.

Lär dig merExample of IFRS 16 in practice

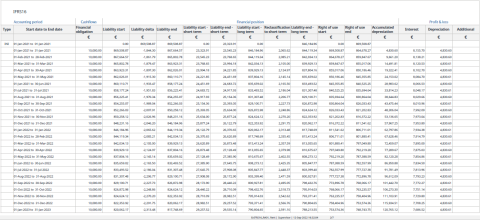

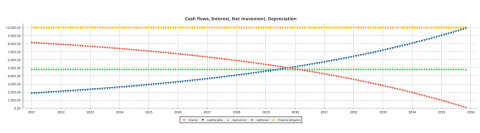

These images illustrate an IFRS 16 financial report example for a 15-year lease contract.

We see the monthly lease payment (€10,000 in this example) and how it is decomposed each month into an interest part and an amortisation part (“net movement”). We also see how the Balance sheet and P&L are impacted by this lease contract. The interest paid on the contract (the red line) shows the typical decreasing trend of a loan, while the depreciation on the right-of-use asset (RoU) is constant in time (the green line).

How to become IFRS 16 compliant

From our experience implementing IFRS 16 software for multinational clients, we advise that you keep these steps in mind as you go through this process.

1. Assess your situation

How many leases do you have? How many lease management systems do you currently use? Identifying your starting point, even without the extensive data collection that will come later, will help in selecting a software system and financial partner for implementation.

2. Select a software solution suitable for IFRS 16 reporting

The information applied to the IFRS 16 standards should be handled in a SOX-compliant way with clear history of changes and authorised workflow, a level of maturity in data management that a simple spreadsheet will not offer. The process of selecting IFRS 16 software is an important step in your implementation process and you should be sure to choose software that has been validated by the top accounting firms.

3. Choosing the team

Once the target model has been decided, the implementation starts and the right stakeholders need to be involved: group and local finance departments, contract management, the external auditor, and possibly external consultants to run the project and act as system integrator. Don’t forget to include internal IT and relevant technology vendors.

4. Select a reporting method compliant with IFRS 16

The data requirements for the contract life cycle depend heavily on the transition scenario that is adopted. For a full retrospective approach, the lease contracts are administrated as if IFRS 16 would have been in use from the start. This means that all life cycle data needs to be entered into the systems for all existing contracts. For the modified retrospective approaches the data requirements are less ambitious. For a successful IFRS 16 implementation, it is important to decide which approach to adopt.

"The range of potential IFRS 16 impacts is wide: 53% of entities would experience an increase in debt of over 25%"

- PwC

5. Collecting the data

An important step will be to collect all relevant contract data and migrate the data to the contract management system. This should be supported by relevant tools for data migration and cleaning. Especially if you decide to adopt the full retrospective approach, the data requirements are considerable.

6. Implementation according to international financial reporting standards

Planon’s IFRS 16 implementation approach has four phases, starting from scoping the project, through technical set up, to support during go-live. This implementation phase requires both technical expertise to set up systems, and also accounting knowledge to determine how use-cases will be applied.

7. Testing

After implementation, but before go-live, testing takes place. During testing, it is recommended to include all exchanges of data in the testing. One could also consider embarking on a certification process for the accuracy of journal entry exchange between the lease contract administration and the general ledger.

8. Training

Training of end users is also a critical step in the implementation. Training is especially important to make the most of an IFRS 16 implementation, so the result is not only IFRS 16 compliance but also improved contract management. This means that contract managers have a clearer overview of the lease portfolio and can better anticipate management actions such as stage transitions, renegotiations and exercise of renewal and termination option.

Lessons learned from IFRS 16 software implementations

Lessons learned from IFRS 16 software implementations

- Based on early adopters, these are the lessons learnt and examples which will help you to successfully move to IFRS 16: Involve stakeholders in time, including local teams/colleagues in different countries.Take care of data (completeness and quality).Understand scope of your limitations, ERP, number of entities, currencies, interface and sourcing system. Learn from Refresco’s IFRS 16 implementation with KPMG in this example.

- Assemble a comprehensive RFP to source what is needed for software and services. Understand time constraints and include provision for slacks, testing errors, corrections and buffers. Full retrospective is complicated and time consuming, hence one lesson learned is to concentrate on a modified approach for IFRS 16. Set up an approach for calculation of interest/borrowing rate and indexations based on your contract portfolio.

- Learn more from Accenture on where to start with your IFRS 16 lease accounting implementation in this white paper full of tips & tricks. Assemble a comprehensive RFP to source what is needed for software and services.

These lessons learned will help you to plan and execute a successful IFRS 16 implementation project for your organisation and ensure the lease accounting software is successfully implemented. Please contact Planon if you need assistance becoming compliant with either IFRS 16 or ASC 842.

Global success stories

Refresco

Refresco has more than 1,800 leased assets worldwide. In order to get compliant with the new IFRS 16 lease accounting standards, all external reports needed to comply with the new regulations.

Upptäck mer

Affidea Group

Affidea Group has selected Planon’s Lease Accounting solution to comply with IFRS 16, the standard replacing IAS 17. Accounting firm KPMG is advising Affidea as skilled implementation partner, ensuring a smooth, compliant and timely implementation.

Lär dig mer

TIP

Driven by IFRS 16 compliance, in 2016 TIP started a project to assess the impact on its financial statements based on the full retrospective transition approach. TIP selected Planon Universe because of its full cloud deployment.

Upptäck mer